What is domain in testing ?

Domain testing is a type of software testing that focuses on the specific area of functionality in which the software under test operates. It involves testing the application with various inputs to ensure that it behaves as expected and produces the desired output. Domain testing is usually done by testers who have a deep understanding of the domain in which the software operates.

Why domain knowledge matters?

Domain knowledge matters when it comes to understanding the context of a tweet like this. Without domain knowledge, it’s difficult to understand the sentiment behind the tweet and what the user is trying to communicate. With domain knowledge, you can understand that the user is expressing their enjoyment of the new Batman movie and can use this information to inform your marketing strategy or other decisions.

Introduction to Banking Domain

Banking domain is a term used to describe the activities related to banking, such as deposits, loans, investments, and other financial services. Banks are responsible for managing and safeguarding customers’ money and providing them with financial advice. Banks also provide services such as credit cards, debit cards, online banking, and mobile banking. Banks are regulated by government agencies to ensure that they operate in a safe and secure manner.

Characteristics of a banking application

1.Secure login: Users should be able to securely log in to their accounts with a username and password.

2.Account management: Users should be able to view their account balances, transfer funds, and pay bills.

3. Transaction history: Users should be able to view a detailed history of all their transactions.

4. Fraud protection: The application should have measures in place to protect users from fraud and identity theft.

5. Customer service: The application should provide customer service options such as live chat or phone support for any questions or concerns users may have.

6. Mobile access: The application should be accessible from mobile devices, allowing users to manage their accounts on the go.

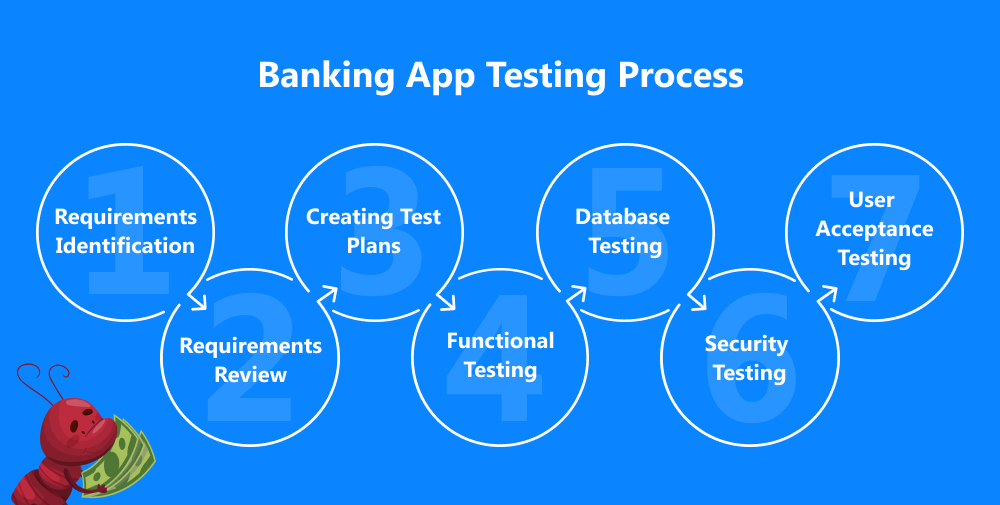

Stage of testing Banking Application

As was mentioned, banking app testing is complicated and holistic. Therefore it is a good idea to have a roadmap to guide you to set goals. In essence, QA workflow can vary from project to project, but in general QA teams consider the following steps:

Requirement gathering and review

At this stage, a QA team gathers, studies, and reviews project requirements. The aim is to clearly understand the way each app function should work and detect possible errors that can relate to ambiguity, incompleteness, inconsistency, and unverifiability of the requirements. It is worth mentioning, that only QA specialists with in-depth domain knowledge can properly cope with this task and all succeeding ones when it comes to finance-related, banking projects. In case there is a certain gap in knowledge, it is advised to take help from a subject matter expert. Besides, if some requirements seem to be controversial or vague, it is better to discuss them with both business and technical stakeholders.

Test Planning

The planning stage is a common one. The QA team proceeds with a detailed QA process planning that covers such important aspects as the scope of testing, test deliverables, tech stack, test environment requirements, roles and responsibilities, scheduling, and many more.

Test case development and creation of automated test scripts

At this stage, QA specialists draw up detailed test cases. Here it is important to carefully cover all scenarios and take into account not only functional but also diverse non-functional characteristics of an application. Besides, to gain high test coverage, get accurate test results, and optimize the testing process, automation testing should be introduced as well and corresponding test scripts should be written. Test automation is a great option for test cases that are repeatedly executed, data-driven, time-incentive, and challenging to be performed manually. Still, manual testing is used to complement automated tests when it comes to carrying out usability tests, exploratory tests, ad-hoc tests, and tests that require particular human supervision.

Test running

This stage lies at the heart of the whole QA process. A banking application is checked against the previously prepared test cases and automated tests are run to check the app for different bugs and bottlenecks.

Here, we offer you to have a look at the types of software testing that are of primary importance in the context of banking app testing:

Functional Testing

In the course of functional testing, it is checked whether all implemented app features work in accordance with the requirements. As long as modern banking apps provide a rich set of features, usually, there is a great number of functional tests covering the most diverse user flows with both positive and negative scenarios.

Database Testing

A database is a separate layer of a bank application that deserves testing with full attention. Specialists performing database testing should have profound knowledge and rich experience in it. This type of testing verifies data integrity, database structure, data types, data flow, data loading speed., etc. Moreover, database testing ensures:

Sample test Case for Net Banking Application

Test Case:

1. Open the net banking login application.

2. Enter valid username and password.

3. Click on the login button.

4. Verify that the user is successfully logged in to the application.

Challenge in testing Banking Domain & their Mitigation

Security is Critical

Banking applications are overloaded with private customer information and data. Therefore, it is essential to ensure security at all levels in an online application. However, security testing becomes quite challenging, especially when there is a variation in the network and operating system across various devices. A banking application must be compatible with all versions, operating systems, and devices etc. Security testing of banking applications is a must, and should adhere to all applicable security standards.

The bank should ensure that all access validation codes and one-time passwords work properly. To ensure that the software doesn’t have any defects or faults, a QA team needs to validate both positive as well as negative sides of the system, reporting it before any unauthorized access occurs.

Complex Data

One of the major challenges that become difficult to address while testing a banking application is the complexity of the data. Banking applications contain all sorts of private information, data, passwords, and assets of the customers stored in their back-end. It is imperative to ensure that the back-end databases are not affected by any malware and that the data within is protected.

A bank certainly needs to have an automation tool to check database connectivity and logical functions continuously. It is beneficial if this is done over a virtual private network (i.e. a VPN) in order to ensure safety across its private data.

Omni-Channel Banking

Omni-channel banking or the branchless banking is the modern concept where the financial markets are functioning without a need of any branch. And, this is a great challenge to the teams for understanding its end-to-end functionality and efficiency in mobile applications.

Performance Failures

Performance levels consist of infrastructure, connectivity, and back-end integration. The transactions happening through the application should be administered at regular interims. Moreover, load and stress tests should frequently be performed to ensure multiple support for transactions at the same time.

Integration with Programs

Banking apps should have the ability to integrate with the programs that are used by users. Also, the applications should be capable to handle every complex workflow without any hurdles and troubles. While integrating with any third-party websites, there is much scope to get bugs and issues, hence the QA teams have to be cautious to deal with issues related to bugs and incompatibility.

Usability testing

Banking apps are being accessed by wide number of people but not every person is having with the technical skills to perform banking tasks with ease. The banking should be user-friendly so that everyone can easily access it, if not these can lead disinterest among the people who are unable to use it with ease. Hence, the app has to be tested across different groups of customer

Real-time Activities

Banking applications need to provide real-time updates on the transactions to the customers as well as the back-end. It is important that the functionality of the application is continuously managed and identified by the testing teams. If there are any network connectivity issues that can hamper the real-time updates of the transactions, the teams should ensure proper testing of the application for any response delay.

Internet Connections and Browsers

User may login the app by using various devices, different browsers and from different internet connections. If the app fails to respond in any of the scenario then this can create a negative impact. Hence, to avoid such situations, teams have to check the performance of the app across all internet connections and browsers.

Time to Market

The addition of new features is a way to attract more customers, but with reduced time to market, there is a pressure that causes testing teams to cut short the testing cycles.

Devices

The present market is having a multitude of devices. If any of the devices is not considered, then this may be a big drawback and can create complexities. Hence, while testing the applications, it is necessary to consider every device across networks and platforms.

Security

Security is an important challenge for the banking sector. When planning for security testing, it is essential to consider all security standards in accordance with mobile devices, networks, operating systems, and platforms.

Mobile Environmental Factors

There are several mobile environmental factors that can affect the behaviour of the mobile bank application. The app can get affected by the background applications, memory card, camera usage, GPS, switching of the network, the state of the battery, etc. The integration of the mobile app with all these features may be a big challenge if the testing team fails to consider all these possible scenarios. Hence, it is important for the teams to consider every environmental factor while testing.

Privacy

Privacy is a challenging issue in mobile apps. Mobile devices are much personalized as they consist of user’s data and identity. These are the important constraints which have to be considered and require the need for security. If the privacy factor fails, then this can create risk for the user data when there is an integration with other third party websites. Hence, while practicing security testing it is important for the teams to consider every factor so that the user-data is secured.